Unlocking Value: The Principle of Materiality in ESG Due Diligence

The intricate and dynamic landscape of ESG can be perceived as daunting, given the rapidly evolving standards and risks. In navigating this landscape, materiality can function as a sharp tool, capable of cutting through the myriad of ESG challenges facing companies while meeting compliance requirements. ESG due diligence expert Iman Reda explains how Steward Redqueen’s approach to effective and efficient due diligence can lead to focused efforts – and value creation.

An investor’s first encounter with the environmental, social and governance (ESG) risks of a prospective investment is during a due diligence. This process grants an investor an abundance of information, and a range of ways to capitalise this at pre-investment stage. Due to the wide breadth of topics, a check-box approach referencing all standards and guidelines means an exhaustive and burdensome process for both the investors and investees. Instead, investors should use the opportunity and limited time available to find relevant but in-depth insights. Mapping materiality of issues is key. Following such a systematic approach for ESG due diligences across every potential portfolio will eventually improve sustainability performance across the portfolio – an important lever for value creation.

What is the value of an ESG due diligence?

Conducting an ESG due diligence enables investors to make more informed investment decisions, manage risks, seize opportunities for value creation, align with stakeholder expectations, facilitate fundraising, and comply with regulatory requirements. Through an ESG due diligence, investors can bring factors such as corporate governance, regulatory compliance, labor practices, climate change, and human rights issues into investment analysis. These are all issues that can impact the financial performance and long-term sustainability of companies. By conducting an ESG due diligence, investors can better understand and address these risks, reducing the likelihood of investment losses. Improved ESG performance can also significantly impact market value, making robust ESG due diligence an essential part of an investors’ strategy. This is why investors are also urging GPs to prioritise ESG upfront. LPs increasingly favor funds that make ESG a part of their value creation strategy and risk management approach and thus present GPs with an opportunity for more fundraising.

How can a materiality assessment lead to an efficient, action oriented outcome?

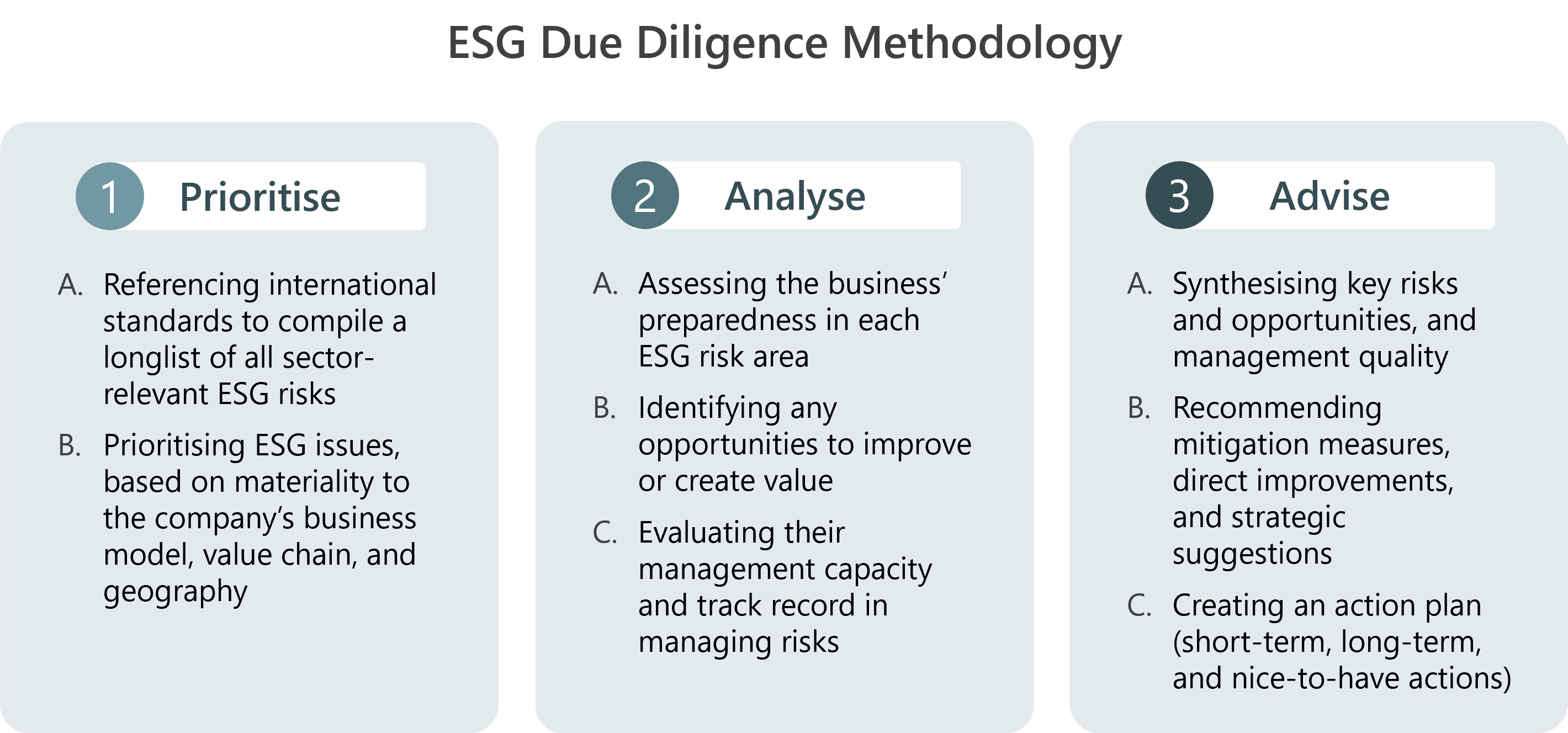

Steward Redqueen applies an in-house methodology, centred around materiality, in order to produce an efficient, action oriented ESG due diligence. The diagram below summarises this methodology and the steps investors can take to derive as much value as possible from this due diligence exercise.

A strong ESG due diligence starts with prioritising the sustainability risks facing a prospect. To do this, investors should reference standards set by international organisations (e.g., SASB, IFC, ILO, etc.) and a broad range of competition – from best-in-class to laggards (sustainability-wise) – across the industry. This process should first consider all potential ESG risks and opportunities of a prospect, then prioritise based on context.

The second step analyses the ESG policies, commitments and structural incapacities that would affect the prospect’s ability to serve their stakeholders and the environment.

The final step of this investigation paints a clear picture of the business’ key opportunities and areas for improvement and offer advice along an urgency-based timeline.

These conclusions and recommendations set the stage for investors to engage portfolio companies on more ambitious and meaningful sustainability strategies, post-investment. Plans should align with each investee’s core business objectives, ultimately driving an investor’s long-term value-creation mandate. In doing so, investors should aid their investee in developing suitable policies to institutionalise these strategies. Companies that already have these policies in place, should continue to be pushed in terms of implementation and management. Taking this action-oriented approach across all prospective investments will tighten the ESG performance of individual companies, while supporting investors in keeping oversight even as a portfolio grows and diversifies. As a portfolio strengthens its ESG credibility, these benefits may eventually be felt at a fund level through higher returns on investment and easier access to capital.

Reach out to Iman Reda if you’d like to know more about conducting an ESG due diligence