Emissions accounting for De Lage Landen

We helped DLL to implement and improve an approach to emissions accounting for its equipment portfolio, allowing DLL to get an accurate picture of its financed emissions

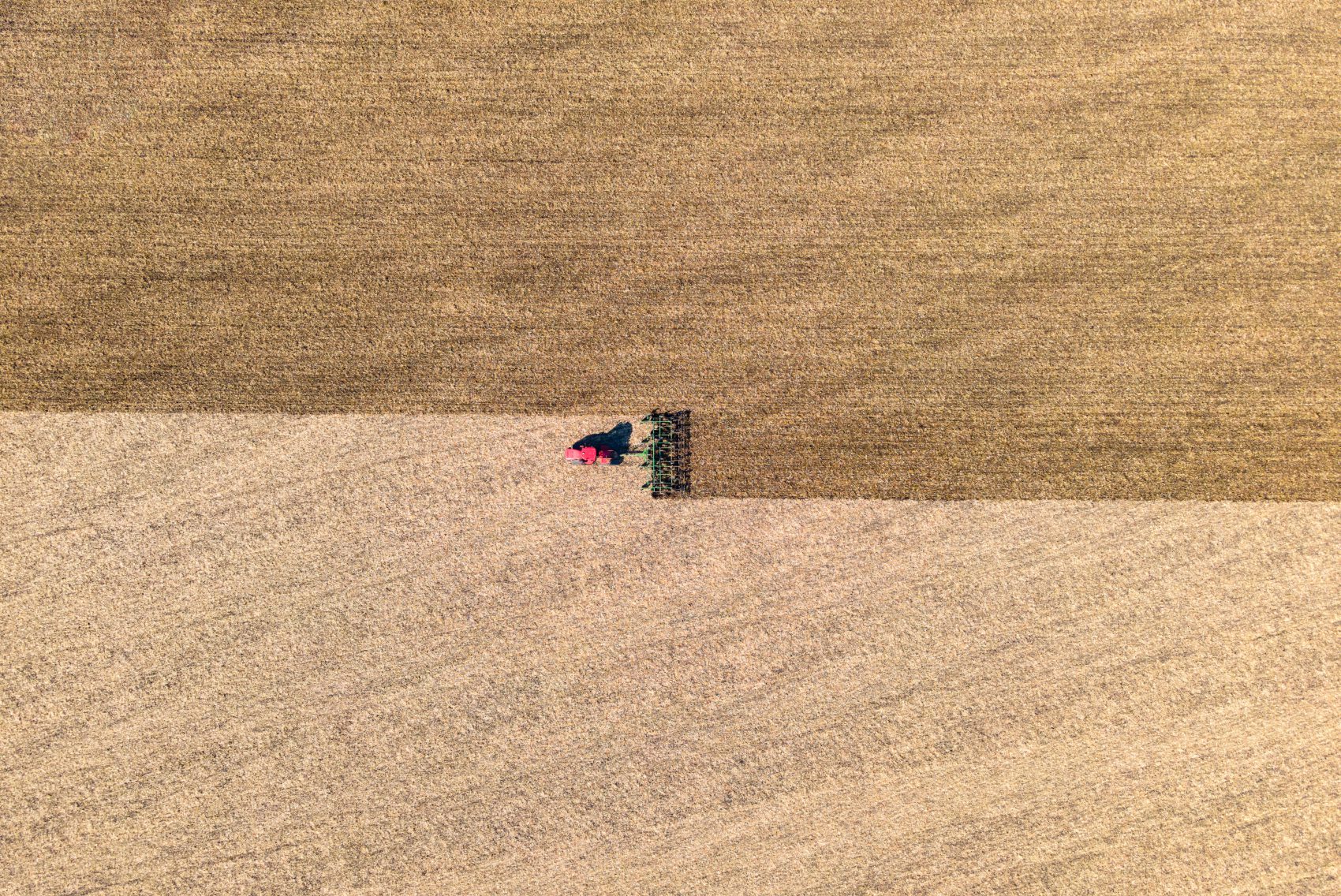

Through its portfolio, De Lage Landen (DLL), a subsidiary of Rabobank, is exposed to some of the most climate-sensitive sectors and countries. Holding one of the largest agricultural, transport and industrial equipment portfolios globally, DLL needs to develop an accurate picture of its financed emissions and set out clear targets to green its portfolio. We supported DLL with refining its approach to greenhouse gas (GHG) emissions accounting and navigating different pathways to decarbonisation.

As an asset financier, DLL has little visibility on the usage or energy consumption of the assets it finances. We guided DLL in identifying the most relevant data sources and approaches to estimate a baseline emissions profile across different asset types and markets. In addition, we assisted DLL in identifying areas of improvement for continuous monitoring in the future, looking at the necessary methodologies, data, infrastructure and governance. Moreover, we laid out different (technological) scenarios that shape decarbonisation roadmaps in the equipment industry. By developing a decarbonisation narrative and framework, we set the groundwork for a more comprehensive mitigation strategy for DLL’s portfolio.

While GHG accounting is mostly constrained by data availability, DLL has placed itself ahead of the market by kickstarting the processes internally and recognising that improvements need to be made over time. Our engagement has helped DLL to scale its GHG accounting practices and build more comfort around the generated insights so that these can be used for portfolio steering.